Two very important macroeconomic figures were released yesterday – the consumer price index and housing starts for July 2016. Both point to a sluggish, but growing economy.

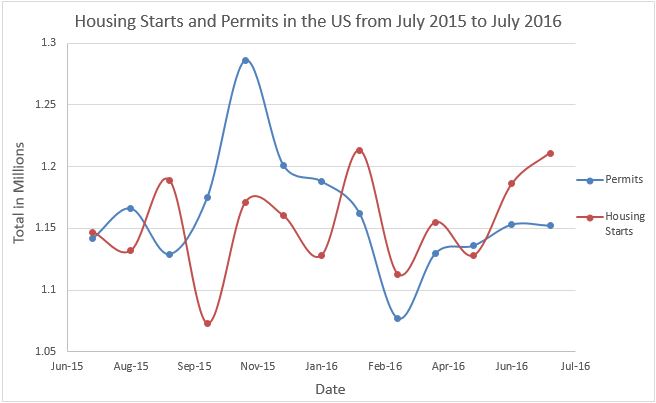

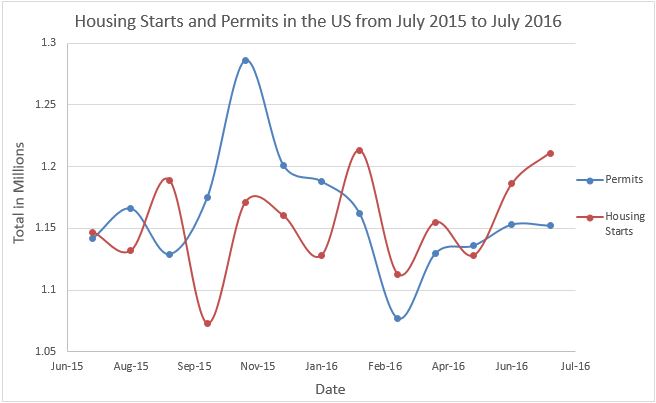

Housing starts increased 2.1% in July. The bulk of the increase was in multifamily dwellings which increased 8.3%. Weather can impact housing starts, so I put more faith in the change since last July, which is 5.6% higher. Again, this was primarily in multifamily units. Single family home starts have climbed 1.3% since last July. The weakest market is in the Northeast where housing starts have fallen 15.7% since July 2015. The South has benefited from the largest increase of 11.1%. All of these figures are seasonally adjusted.

The small change in permits may indicate that the housing market will slow in the next quarter. Permits decreased 0.1% since last month and are up only .9% from a year ago.

The Census Bureau report can be accessed at

Census Report.

The seasonally adjusted consumer price index was unchanged in July. It is up only 0.8% for the prior 12 months. However, this was largely because of a sharp decline in gasoline prices. The price of gasoline dropped a seasonally adjusted 4.7% in July alone (5.5% without the seasonal adjustment) and 19.9% over the past 12 months! Grocery prices have also declined in the past 12 months. Consumers have benefited from a 1.6% decrease in this category. When these are omitted, prices increased .1% in July and 2.2% for the prior twelve months. Economists frequently put more credence in this figure since it negates the volatile impact of energy and food prices. However, medical expenses have increased 4% since July 2015, and were up .5% in July. The tighter housing market has also helped propel housing costs up by 3.3% for the past 12 months.

The Bureau of Labor Statistics report can be accessed at

CPI Report.

Image Credit: istockphoto.com