Below are the highlights from the Bureau of Labor Statistics press release, Consumer Price Index – September 2024:

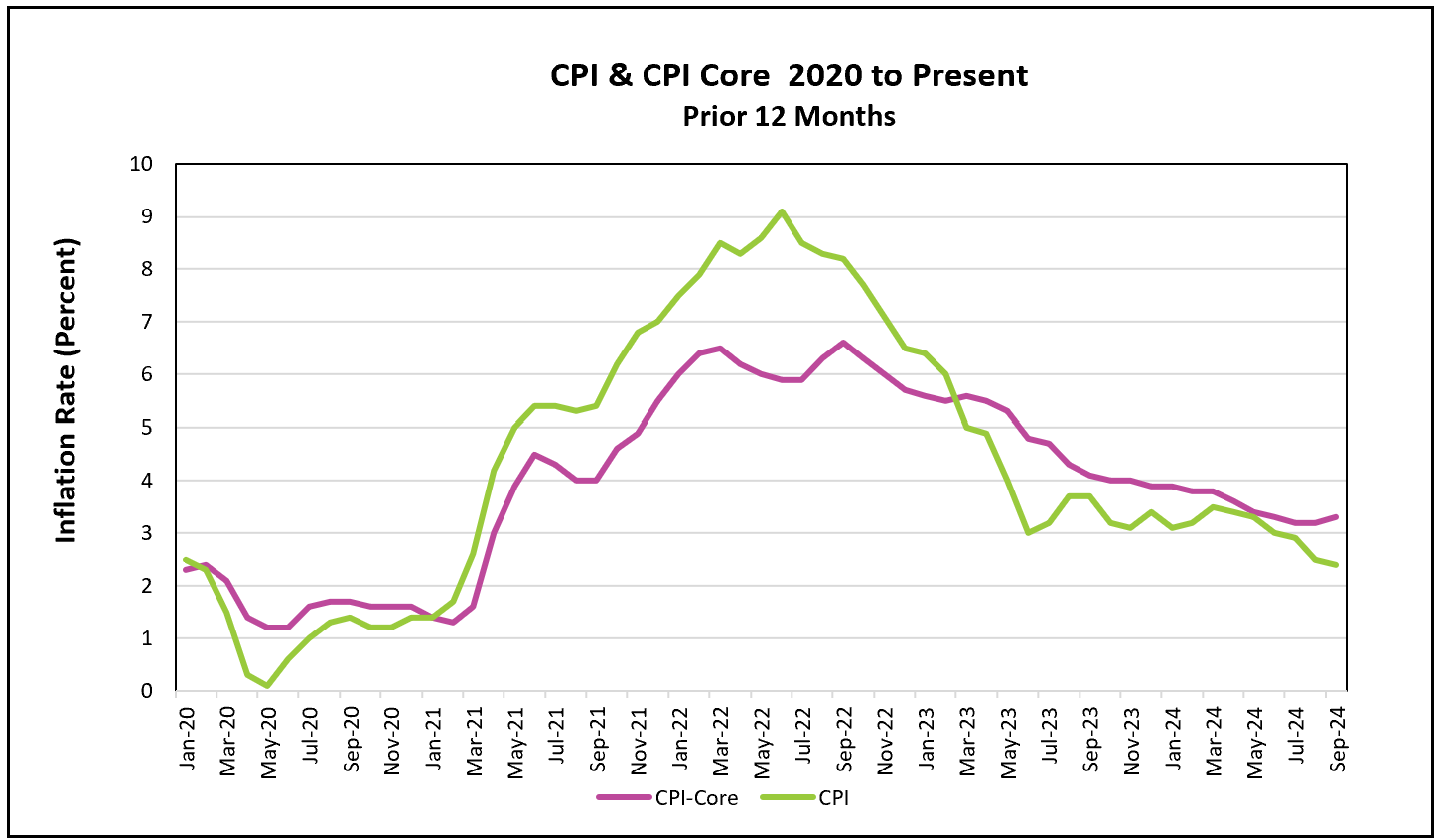

Inflation was higher than what most economists had predicted, suggesting that policymakers at the Federal Reserve may be hesitant to make aggressive rate cuts and are likely to opt for a maximum reduction of 0.25% in their benchmark interest rate at their upcoming November meeting.

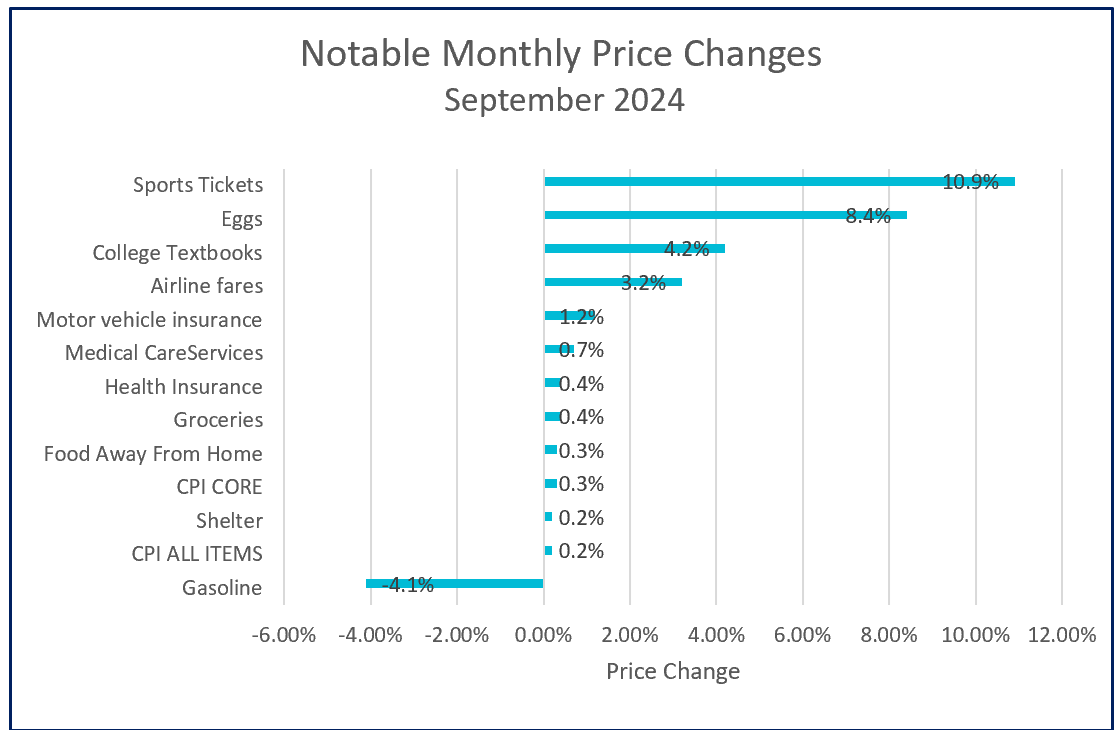

The all-inclusive CPI was driven primarily by increases in food and shelter prices, which accounted for over 75% of the overall rise. Food prices posted the largest monthly gain since January, with eggs contributing significantly to the rise. Egg prices surged by more than 8% in September after increasing by 4.8% in August and 5.5% in July. This sharp rise in egg prices can be attributed to the impact of bird flu, which infected nearly 9 million chickens.

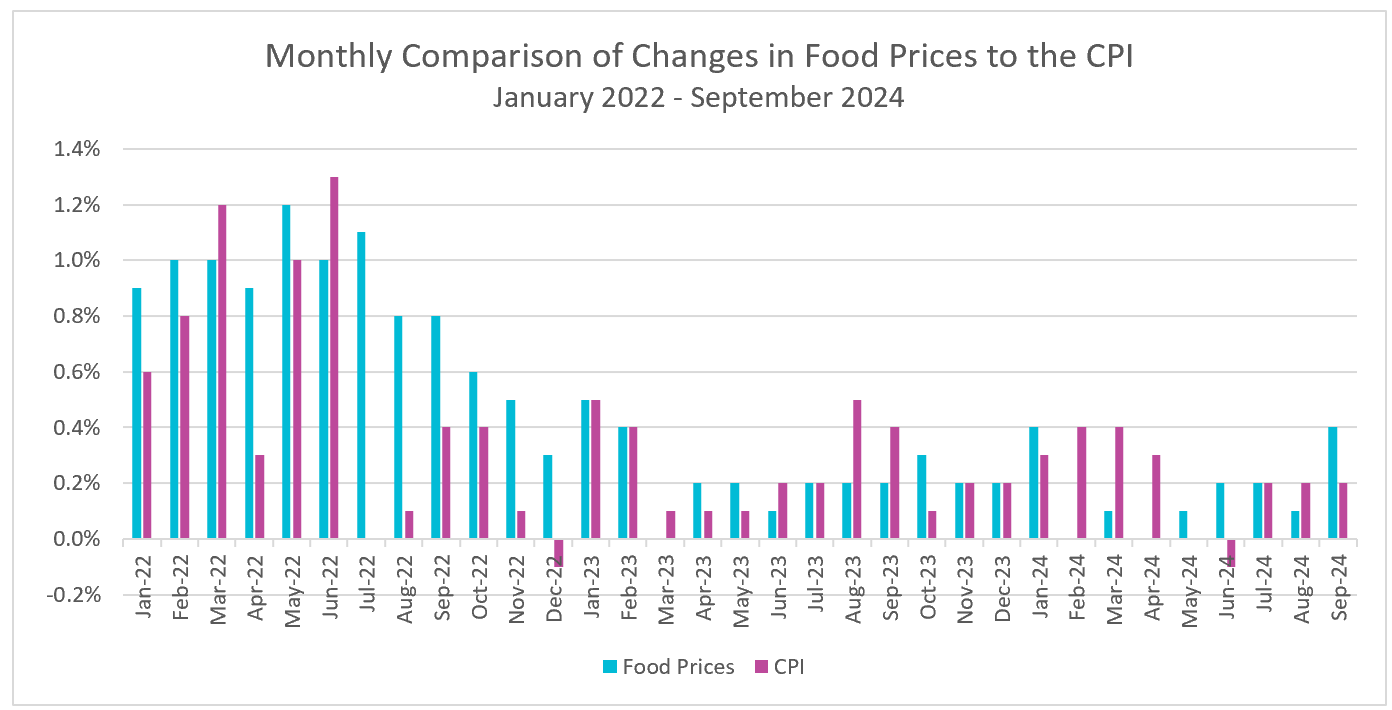

Over the past year, food prices have risen by 2.3%, down from the sharp increases seen at the onset of the Covid-19 pandemic, when supply chain disruptions and rising fuel costs pushed food prices higher. The graph below compares the monthly change in the food and consumer price indexes since 2022. Note that food price increases exceeded the CPI between April and December 2022, causing much hardship for households on a tight budget. Since then, food prices have increased in line with the CPI. Grocery prices have increased at a slower pace, and the cost of dining out has exceeded the CPI.

The shelter index has outpaced inflation for several years. High mortgage rates made home ownership less affordable. They also restrained the housing supply as homeowners were reluctant to sell if it meant purchasing a new home with a higher mortgage. Higher prices for building materials, labor shortages, and supply chain disruptions continued to drive up the cost of constructing new homes, increasing the prices of new housing units. Economists will be encouraged by signs housing costs are moderating. The cost to rent a primary residence rose 0.3% after increasing 0.4% in August and 0.5% in July. In addition, the increase in the owner’s equivalent rent of residences, a measure of how much it would cost for someone to rent a house that a person owns, slowed to 0.3% from 0.5%. Lower housing costs will bring long-awaited relief to many families as the growth in housing costs finally nears the increase in wages. Economists had anticipated this slowdown for months, as the shelter index typically lags changes in rental rates. Since the shelter index makes up about one-third of the CPI, any sustained cooling will significantly impact the CPI.

The core price index, which excludes volatile items like food and energy, is higher than the all-inclusive CPI, largely because gasoline prices fell. Gasoline prices fell 4.1% in September and are 15.3% less than a year ago. Lower gas prices have left consumers more money to spend on other goods and services.

Listed below is a summary of notable price changes during September. Among the largest increases were college textbooks and sporting tickets, both of which hit record highs.

Policymakers at the Federal Reserve reduced their benchmark rate by 0.5% at their September meeting, thinking they had won their quest to tame inflation. They also implied that an additional rate cut would be forthcoming in November. Since then, the BLS has released its employment and inflation reports for September. Each suggests the economy may be stronger than initially thought. The employment report surprised analysts with higher-than-expected payroll growth and a lower unemployment rate. Increases in September’s CPI were more than expected in both the all-inclusive and core price indexes. These positive indicators may lead the Fed to reconsider a large rate cut at their November meeting. The advance estimate for the third quarter’s growth and September’s PCE price index, the inflation index favored by policymakers, will be released the week before their meeting. HRE will provide a summary and analysis of each of these reports shortly after they are released.