The US economy contracted 0.3% during the first quarter, aided by a surge in imports and cuts in Federal spending.

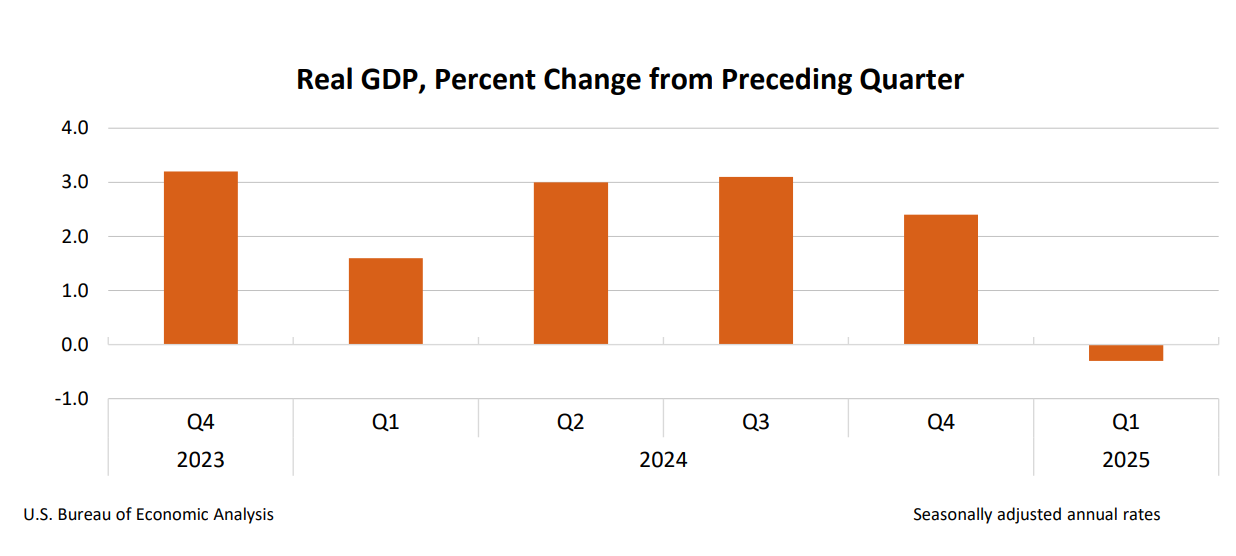

The U.S. economy’s 0.3% contraction during the first quarter (January–March) of 2025 is a sharp reversal from the 2.4% growth recorded in the fourth quarter of 2024. According to the Bureau of Economic Analysis’s Gross Domestic Product, First Quarter 2025 (Advance Estimate), this marks the largest decline in three years and was driven primarily by a surge in imports and reduced government spending.

During the last quarter of 2024, the US economy grew at an annual rate of 2.4%, and inflation was 2.3%, approaching the Federal Reserve’s 2% target. Unemployment remained low as businesses expanded hiring. However, the economy’s trajectory shifted following the implementation of President Trump’s policies, particularly his aggressive tariffs, which have shaken business and consumer confidence. The first quarter contraction was the first since early 2022, and, as in that period, a surge in imports was the primary contributor. In 2022, the US economy was recovering more rapidly than most other countries from the COVID-induced global contraction, so Americans purchased more from other countries. (RGDP 1st Quarter 2022) However, in 2025, looming tariffs generated a rush to buy foreign-made goods before tariffs increased the prices of imported goods.

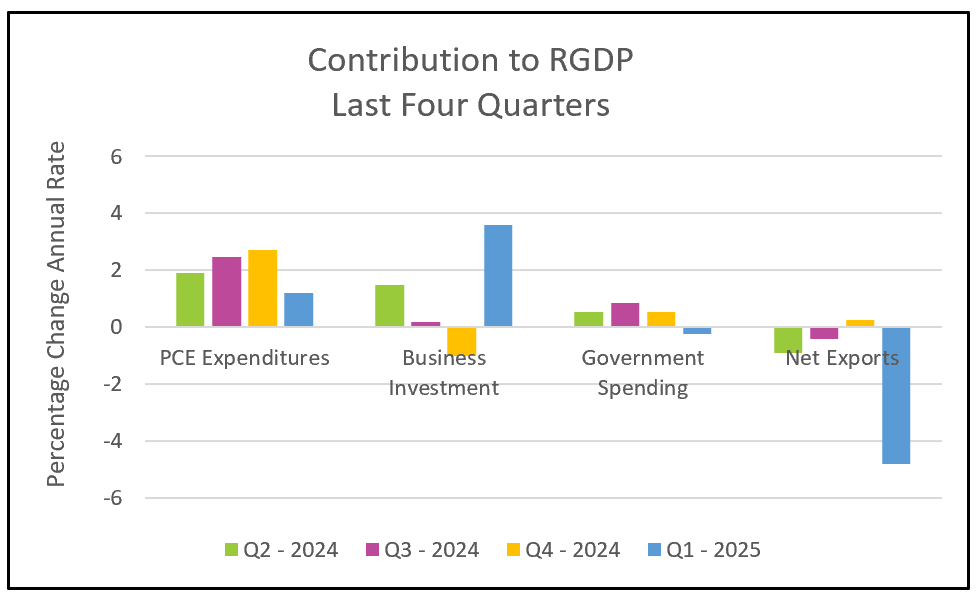

Imports surged 41.3% during the first quarter as businesses acquired equipment and boosted their inventories. Consumers purchased foreign-produced items, particularly foreign cars, ahead of tariff hikes. Since RGDP tracks domestic production, imports must be subtracted to avoid overstating economic activity. In contrast, exports are added because they reflect domestic output sold abroad.

Net exports and inventories are subject to wide fluctuations and generally balance out over time, so economists monitor the final sales to private domestic purchasers for a better snapshot of demand, which rose at an annual rate of 3.0%, up from 2.9% in the prior quarter—an encouraging sign for the underlying demand.

The decline in government spending reflects reduced military aid to Ukraine, marking the first such cut since the second quarter of 2022. Larger cuts in non-defense spending loom since the President has proposed a $163 billion cut in discretionary spending, potentially bringing non-defense federal outlays to their lowest share of GDP since the 1960s.

The graph below provides the contributions of personal consumption expenditures, business investment, net exports, and government spending during the past four quarters.

Many economists expect the growth of aggregate demand to slow further. Policy changes typically take time to ripple through the economy. Cuts to federally funded jobs and programs will likely increase unemployment and reduce real disposable income in the coming quarters. Inflation is also projected to rise as more goods become subject to tariffs. Although consumer spending rose in the first quarter, it was less than half the rate of 2024’s fourth quarter and marked the smallest increase since the second quarter of 2023. Growing uncertainty is prompting many consumers to pull back.

The University of Michigan’s Consumer Sentiment Index declined for the fourth straight month, with expectations plunging 32%, the sharpest three-month drop since the 1990 recession. Rising prices are squeezing low-income households, while plunging stock prices are rattling wealthier Americans.

The PCE price index, the Fed’s preferred inflation measure, climbed to an annual rate of 3.6%, while the core PCE price index rose 3.5%—both the highest readings in a year and well above the Fed’s 2% target. These developments raise stagflation concerns, as the combination of slowing growth and rising prices complicates the Federal Reserve’s job.

Over the past two years, the Fed has maintained elevated interest rates to cool inflation, successfully bringing the PCE price index down from 6.6% in March 2022 to 2.1% by September 2024. Encouraged by this progress, the Fed began lowering its benchmark rate. However, the recent inflation uptick led policymakers to pause rate cuts. President Trump has urged further reductions to stimulate growth, but Fed Chair Jerome Powell remains firm: no additional cuts will occur until there is clear evidence that inflation is under control.

The Bureau of Labor Statistics reported that payrolls rose by 177,000 in April, and the unemployment rate held at 4.2%. However, because data collection occurred early in the month, these figures do not yet capture the latest wave of layoffs. HRE will publish its detailed employment summary and analysis later this week.