Key takeaways from the Bureau of Labor Statistics report, The Employment Situation – April 2025, include:

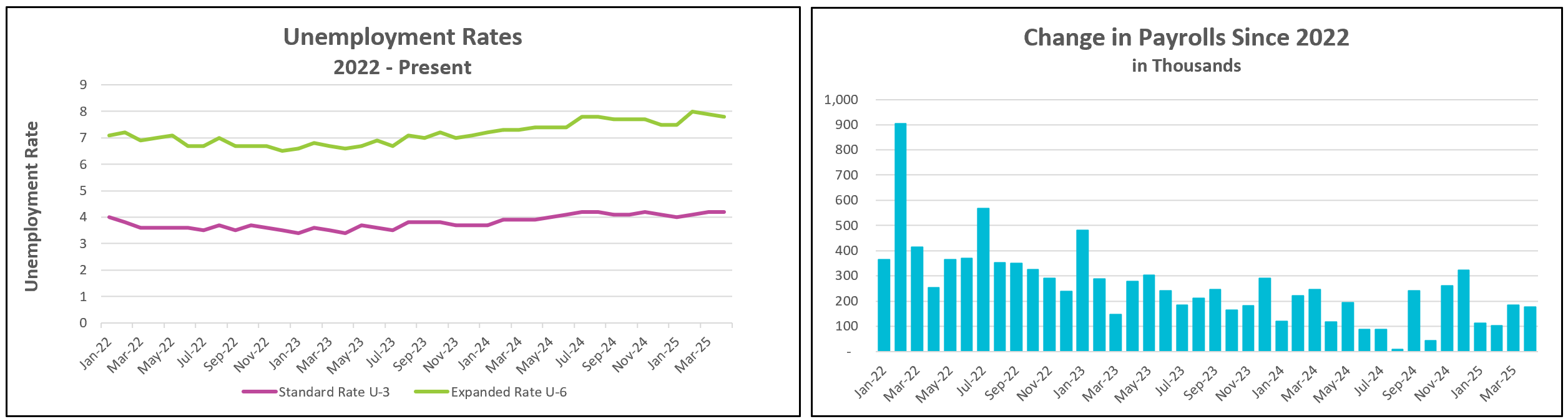

The U.S. labor market remains surprisingly resilient despite growing economic uncertainty. The latest jobs report exceeded expectations, showing that businesses are still hiring at a healthy pace. The unemployment rate held steady. This suggests that employers are still wary of letting workers go, likely scarred by the difficulty of rehiring during the aftermath of the COVID-19 pandemic. Many companies appear determined to retain their workforce, even as the broader economic picture becomes more uncertain.

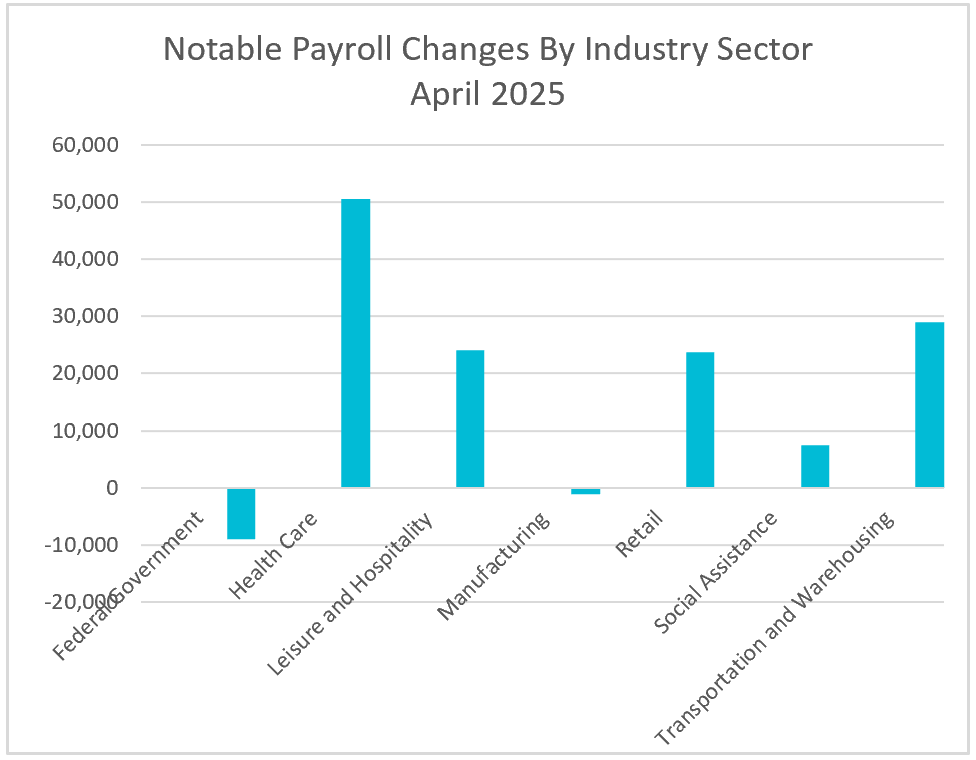

Healthcare led the way in job creation, continuing its long trend of absorbing more workers as the population ages and demand for services grows. The sector has added an average of 51,000 workers per month over the past year. Transportation and warehousing also saw gains, likely bolstered by a wave of preemptive purchases as businesses and consumers scrambled to buy goods ahead of incoming tariffs. April’s 29,000 increase more than doubled the monthly average of 12,000.

However, not all sectors shared in the growth. Federal government employment declined by 9,000 employees, reflecting the administration’s push to shrink the size of the federal workforce. These numbers don’t include workers on paid leave or those receiving severance, which suggests the actual cutbacks may be deeper. Fortunately, state and local governments helped offset the losses with increased hiring.

Meanwhile, manufacturing took a hit, losing 1,000 jobs and showing a notable drop in average weekly hours worked. This trend is particularly concerning, given that tariffs are supposed to bolster the manufacturing sector. If the goal is to revitalize American industry, the early indicators aren’t encouraging. However, it is much too early to draw any conclusions.

The household survey, which includes the self-employed, agriculture workers, and non-compensated family members in family-run businesses, showed that over half a million people entered the workforce, and more than 430,000 found jobs. Wage increases did slow somewhat, but they continued to match inflation, which helped ease inflationary pressures without sacrificing workers’ purchasing power.

Still, multiple policy changes are casting a long shadow over the labor market. Economists expect tariffs to raise prices and reduce demand, particularly for exports, while increasing input costs for manufacturers relying on imported materials. Federal spending cuts are already reducing employment in government agencies and are likely to ripple through universities and research institutions that depend on government funding. Additionally, the administration’s aggressive stance on deportation is straining industries reliant on migrant labor, such as agriculture, hospitality, and healthcare. As the pool of foreign-born workers shrinks, employers may be forced to raise wages to fill positions, ironically tightening the labor market even as hiring slows.

Businesses may be adding to payrolls because they are betting that the tariffs are temporary—that the tough talk on trade and immigration is just a negotiating tactic, and more stable policies will soon follow. But unless there’s a shift in direction, the labor market’s current strength could give way to softness in the coming months. For now, the U.S. job market continues to surprise—whether that will last is anyone’s guess.