The surging job market likely prevents the Fed from trimming its benchmark rate in January.

Key takeaways from the Bureau of Labor Statistics Report The Employment Situation – December 2024 include:

An excellent employment report brings mixed news for investors, businesses, and consumers. The labor market’s strength likely rules out any rate cuts by the Federal Reserve later this month. In response, investors sent the stock market lower, and bond yields rose. The Fed’s delay means that interest rates for mortgages, car loans, and other long-term financing will remain elevated for an extended period, increasing borrowing costs for businesses as well.

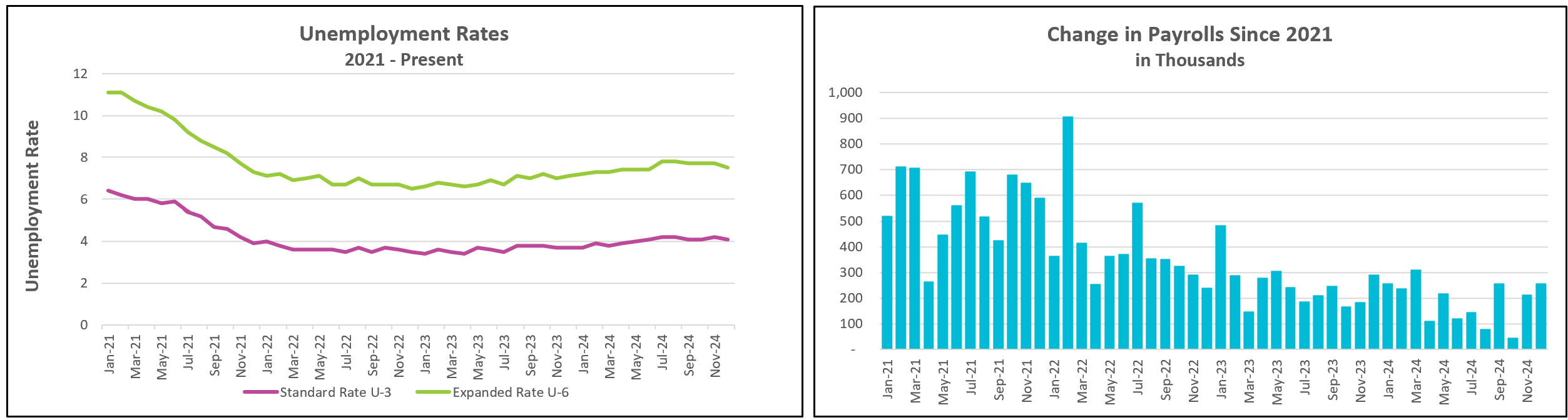

The labor market showed signs of cooling in 2024. Earlier in the year, central bankers expressed concerns about the pace of the slowdown and began trimming their benchmark interest rate. However, after reviewing this month’s report, those concerns are likely diminished.

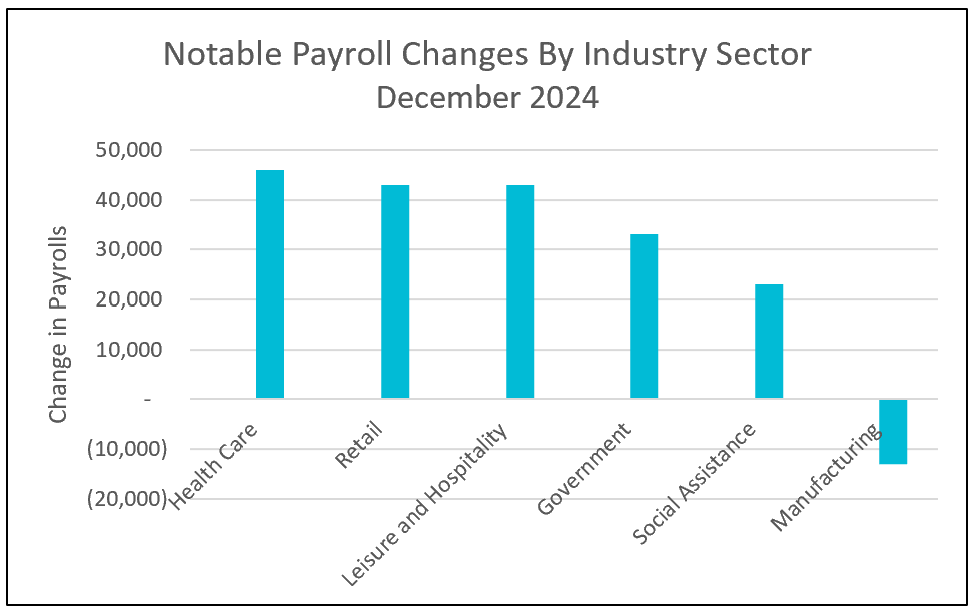

Payroll gains in 2024 were concentrated in the service industries, with nearly 2.2 million jobs added over the year. While this figure is lower than the gains during the labor market recovery from the COVID-19 pandemic, it exceeds the job growth seen in 2019, the year before the pandemic began. Temporary help services employment rose for the third consecutive month. This trend is significant, as temporary hiring often serves as a leading indicator of future full-time job growth. Businesses frequently bring on temporary workers before committing to permanent hires.

However, the manufacturing sector continues to face challenges, losing 13,000 jobs in December and 93,000 jobs throughout 2024. President-elect Trump’s proposed tariffs are intended to boost manufacturing.

The unemployment rate edged down slightly—not because people left the workforce, but because more individuals found jobs. This is a positive sign, as it reflects a healthier economy than when a declining unemployment rate results from individuals dropping out of the workforce altogether.

In 2024, the unemployment rate fluctuated between 3.7% and 4.2%. A broader measure of unemployment, U6, also dropped to its lowest level since June. U6 captures individuals whose employment status has been negatively affected by economic conditions, including those who are unemployed, discouraged from seeking work or working part-time involuntarily.

Wage growth slowed but likely remained ahead of inflation. Higher real wages offer much-needed relief to households, helping them better manage their budgets. In December, wages increased by 0.3% and were up 3.9% for 2024.

The Bureau of Labor Statistics will release its year-end Consumer Price Index tomorrow. Higher Rock will provide a detailed summary and analysis following the release of both reports.