Here are the key takeaways from the Bureau of Labor Statistics’ report, The Employment Situation – September 2024:

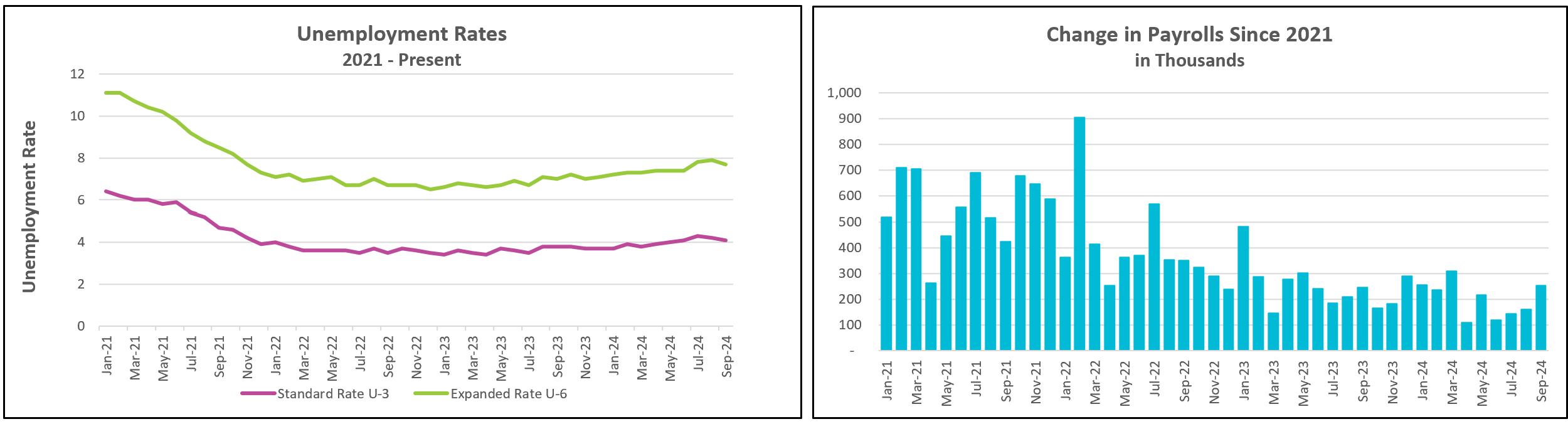

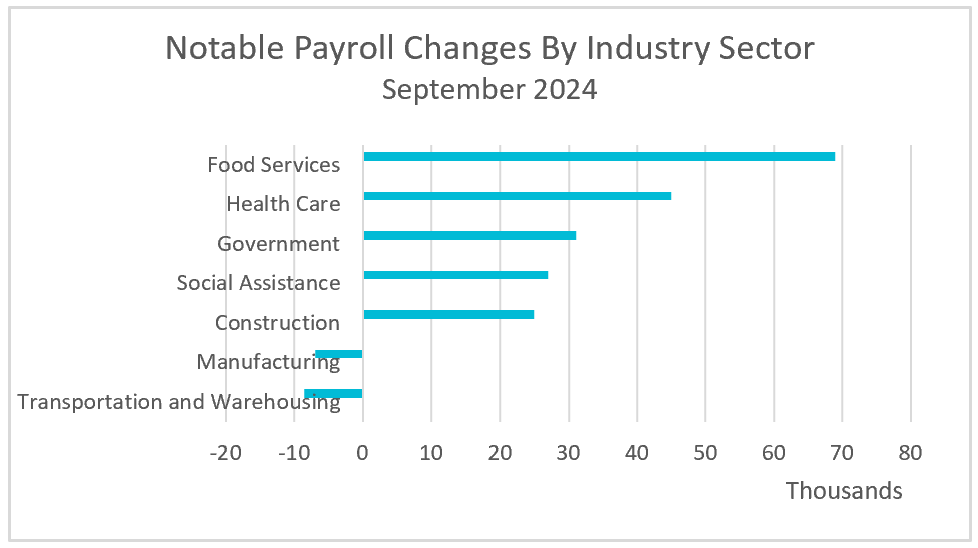

Investors, Federal Reserve policymakers, President Biden, and Vice President Kamala Harris are celebrating today’s employment report. Employers added 254,000 workers to payrolls, far exceeding initial estimates of 150,000. Additionally, hiring in July and August was more than previously reported, with payroll figures revised upward by 72,000 workers. Unemployment fell, and real wages increased.

Recent employment reports indicated a slowdown in hiring and a slight increase in unemployment. Policymakers were concerned that a weakening labor market could trigger a recession. As more people lose jobs or struggle to find new ones, their disposable income decreases, limiting their ability to spend on goods and services. Households then cut back on non-essential spending and focus on necessities. Since consumer spending drives 60-70% of a country’s GDP, a reduction in demand can lead to a negative cycle of reduced production, fewer hires, and further layoffs.

The fear of a weakening labor market was a significant factor behind policymakers reducing their benchmark interest rate by 0.50% instead of the usual 0.25%. Many economists had expected the Federal Reserve to cut rates by another 0.50% at their next meeting, but the strength of this employment report likely takes that option off the table.

Job gains were broad-based, though the manufacturing sector experienced a decline in employment, primarily due to cutbacks in automotive production. Lower interest rates should boost car sales in the near future.

It is reassuring that the unemployment rate fell for positive reasons—people who entered the labor market were able to find jobs. (The unemployment rate can also decrease when people become discouraged and leave the workforce, as they are no longer counted as part of the labor force.) Additionally, the U-6 rate, which includes those unemployed, discouraged, or forced to work part-time due to economic conditions, fell for the first time since November 2023.

Wages have increased by an average of 4% over the past year, while prices have risen by about 2.5%, making it easier for households to meet their budgets.

While this report is very encouraging, it reflects only one month’s data, and one month does not establish a trend. As this report shows, figures are often subject to significant revisions. In this case, payroll numbers were revised upward, but payroll data has frequently been revised downward over the past year. For example, the Labor Department lowered its payroll estimate from April 2023 to March 2024 by 818,000 workers last August.

The BLS will release September’s CPI report next week, and HRE will provide a summary and analysis shortly after its publication.