President Trump unveiled his vision for overhauling the US Tax Code on Wednesday. Included were large tax cuts to corporations and the wealthiest of individuals. The

Committee for a Responsible Federal Budget projects that his proposal will increase the

budget deficit between $3 and $7 trillion. The significant difference is explained by the proposal's lack of details. The debate is just beginning. Over the next few months, much of the economic news will center on the proposal. How will the tax proposal affect you? To understand the debate, it is important to know the differences between progressive, regressive, and proportional taxes. This blog defines those terms. Future blogs will address the economic implications of the proposals.

The discussion will center on two issues – stimulating the economy and what is fair, or equitable. Is it fair that everyone pay the same tax? Or is it fair that everyone pay the same tax rate? Should a hard-working person with a family of four pay the same amount of tax as a wealthy kid who earns $500,000 in interest and dividends and does not work? Most people would say that the wealthy kid should pay more in tax, but how much more? Should each tax payer pay the same rate? The US income tax structure is progressive, meaning higher income tax payers pay a higher percentage of their income in federal income tax. However, some taxes are regressive, meaning lower income tax payers pay a larger portion of their income on the tax. Still other taxes require the taxpayer to pay a given rate. This is a proportional or flat tax. There will be much debate on whether the tax changes should be more progressive, proportional or regressive.

Progressive Tax

In a

progressive tax system, a tax payer's average tax rate increases as the tax payer's income increases. For example, if Sandra earns $30,000 and pays $2,000 in taxes, while Bill earns $150,000 and pays $33,000 in taxes, there is a progressive tax system because Sandra has an average tax rate of 6.67% and Bill has an average tax rate of 33%.

Most developed countries have a progressive income tax. Policy makers contend that higher income individuals should shoulder more of the responsibility of paying for the goods and services government provides. They are better able to afford it, and perhaps they have more to gain. Higher income people are more likely to travel, and so they benefit more from roads. Wealthier citizens have more to lose from the destruction of war, so they should pay more for the military.

The US tax has become less progressive since 1963, when individuals with incomes exceeding $200,000 ($400,000 for families filing jointly) had a marginal tax rate of 91 percent. Most economists believe that high tax rates discourage people from working. Arthur Laffer uses the

Laffer curve to illustrate that a point is reached when higher tax rates actually decrease tax revenues because so many people choose leisure over work. Assume you are single, earned $200,000, and had the opportunity to earn an extra $10,000. Would you choose work or leisure if you had to pay the government $9,100? If you chose leisure, you demonstrate Laffer's view.

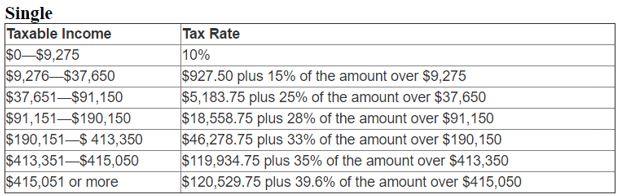

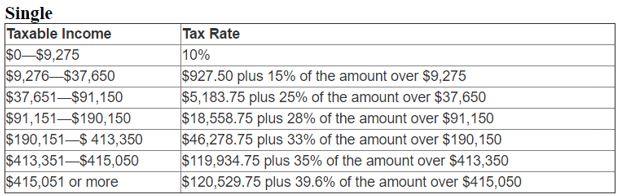

The table below provides the 2016 tax brackets for single tax payers. Note that the

marginal tax rate increases as income increases. For example, individuals with a taxable income of $9,000 would owe $900, or 10 percent of their income, while a person with a taxable income of $200,000, would owe $49,528.92, and they would pay one-third on any added income up to $413,350.

IRS - Tax Brackets

IRS - Tax Brackets

Regressive Tax

A

regressive tax is a tax where low income tax payers pay a larger portion of their income. The average tax rate decreases as the tax payer's income increases.

The sales tax is a regressive tax. Assume the sales tax is five percent, and a basket of goods costs $100. Everyone purchasing the basket would pay a sales tax of $5. User fees to renew a license, park a car, or enter a park are examples of regressive taxes where everyone pays the same amount. People differ on whether this is fair because a regressive tax burdens the poor more than the wealthy. Many states exempt food and clothing from a sales tax to reduce the tax burden on low income families. Generally, if the tax is based on the value of an asset, it is regressive. The exceptions are taxes imposed only on the very wealthy such as estate taxes, which are based on the value of a deceased person's estate at the time of death. No estate tax is owed on estates less than $5.49 million.

Property taxes are another example of a regressive tax because the tax is not based on the owner's income. It is true that wealthier people generally own larger homes than lower income tax payers, but the tax is based on the property value – not the owner's income. For example, a highly-compensated woman may experience a dramatic drop in her income after she retires, but would still owe the same property tax if she does not move.

Proportional or Flat Tax

When all income is taxed at the same rate, the tax is

proportional or flat tax. For example, assume the tax rate equals 25%. A family earning $100,000 would pay $25,000 in taxes, and a family earning $50,000 would pay $12,500. In each case, the family pays 25% of its taxable income in taxes. The oldest example of a proportional tax is the biblical concept of tithing. Israelites were commanded by God to pay 10% of their income. The average and marginal tax rates are equal with a proportional tax because the next dollar earned is taxed at the same rate (marginal tax rate) as the first dollar earned.

A payroll tax (social security and Medicare) is a flat tax because everyone pays 7.65 percent of their income - that is until they earn $127,200, after which the marginal rate falls to zero. Since no taxes are paid on income exceeding $127,200, payroll taxes are technically regressive.

The easiest way to distinguish between a progressive, regressive, and proportional (flat) tax is with an example. Assume three individuals. Sandra is a teacher. Her annual salary is $30,000. Todd works in the athletic department of a university and earns $35,000 per year, and Bill is a mortgage broker who earns $150,000 per year.

Video - Progressive, Proportional, and Regressive Tax Systems

In Scenario 1, Sandra pays $2,000 in taxes, Todd pays $3,500 and Bill pays $40,000. This is a progressive tax system because Bill earns more than Sandra and his average tax rate is higher than Sandra's. In Scenario 2, the three tax payer's incomes remain unchanged, but the government changes the tax system so now Sandra pays $3,000 in taxes. Todd pays $3,500, and Bill pays $15,000. Scenario 2 illustrates a proportional tax system because the average tax rate of all the tax payers equals 10%. In Scenario 3, income is once again unchanged, but the government changes its tax system so Sandra, Todd, and Bill are taxed $4,000, $3,500, and $12,000, respectively. Scenario 3 has a regressive tax system because Sandra, who has the lowest income has the highest average tax rate.

So how would President Trump's proposal affect your taxes? Much depends on the income levels for each bracket and how they affect your average tax rate. Lowering the highest tax bracket from 39.6% to 35% will make the tax code more regressive (but still progressive) since a larger portion of the tax revenues needed must be paid using the lower tax brackets. There are also other proposals such as a change in deductions and a change in the standard deduction that need exploration. Stay tuned: we will keep you informed as negotiations continue.

Please share this and our site with any student or teacher who may find it interesting. We would love to help any economic students you know with our free lessons.