Break-even

View FREE Lessons!

Definition of Break-Even:

Break-even in producing a good or service occurs when revenues from production cover the variable and fixed costs of producing the good or service. There is neither a profit nor a loss at break-even.

Detailed Explanation:

A business achieves break-even when its output is sufficient to cover its costs. Lower production levels result in a loss, but profits increase as production rises above the break-even point. Break-even analysis helps identify how many units a business must sell to earn a profit. Business managers should ask if the derived break-even is achievable, given the competition and size of the market.

Management must identify three variables to calculate its break-even point - price, fixed costs, and variable costs. Production levels do not directly influence fixed costs. Examples of fixed costs include rent, mortgage payments, insurance payments, and salaries of essential personnel. Fixed costs are also referred to as overhead. Variable costs are directly influenced by how much of a good or service is produced. Examples of variable costs include: raw materials, labor directly involved in the production process, packaging costs, and transaction fees.

The break-even formula is:

Break Even # Units = Fixed Cost / (Price – Variable Unit Cost)

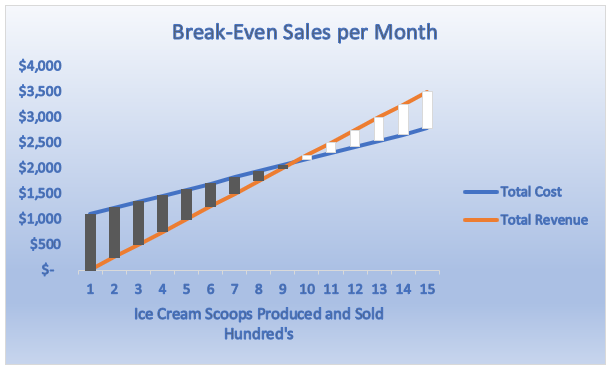

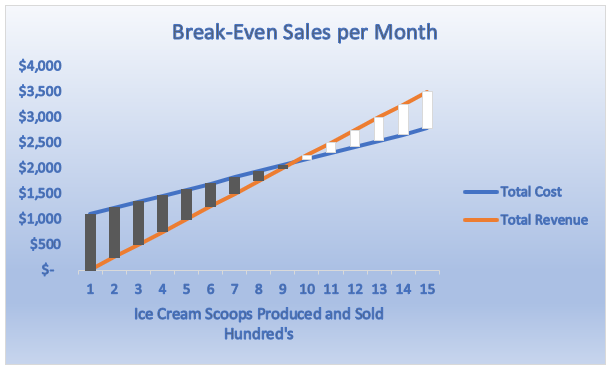

Assume you are considering opening a small ice cream parlor. You estimate your total monthly fixed expense would equal $1,100, which includes rent, office utilities, and other overhead expenses. Ice cream, cups, napkins, and labor are your variable costs. You believe they will equal $1.20 per scoop. You plan to charge $2.50 per scoop. Your break-even would equal 847 ice cream scoops per month. The calculation is below:

Break-even # Units = $1,100/ ($2.50-$1.20)

.On the graph that the total cost and total revenue curves intersect at the break-even point. Once you reach break-even, every additional scoop sold adds $1.30 to your profit.

Dig Deeper With These Free Lessons:

Output and Profit MaximizationEntrepreneurs – Their Vital Role in the Economy

Fundamental Economic Assumptions

Factors of Production – The Required Inputs of Every Business

Marginal Analysis – How Decisions Are Made