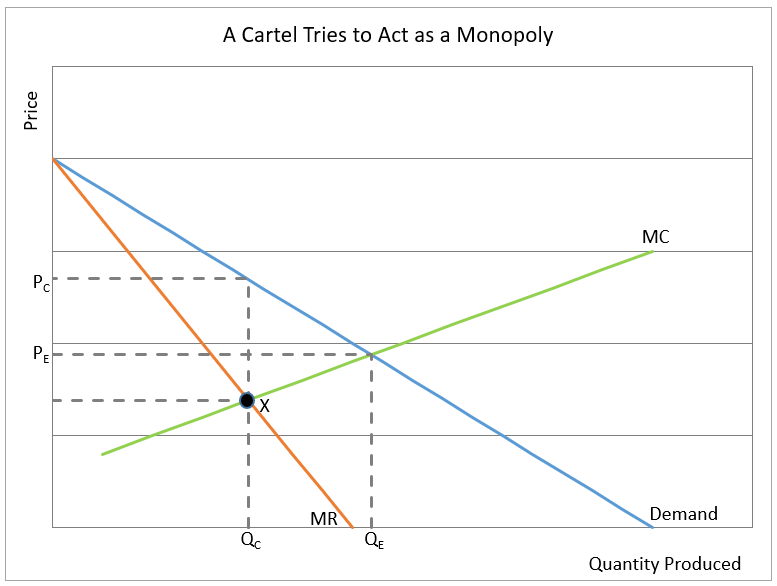

The industry initially produced quantity QE at a market price of PE before the establishment of the cartel. Subsequently, the cartel members agreed to collectively act as a monopoly to maximize the industry’s profits. The graph illustrates the industry demand, marginal revenue, and marginal cost curves. Under a monopoly, the output would be QC, and the price would be PC. However, this results in societal losses due to a higher price and reduced production. Refer to the discussion on monopolies in Market Structures Part I – Perfect Competition and Monopoly for an explanation of why monopolies produce QC and charge PC.

The challenge arises in allocating the reduction in output to QC among the cartel members, necessitating negotiation. While the cartel collaborates to maximize joint profit, it fails to optimize individual company profits since each company could earn higher profits by violating the cartel terms and increasing production. This inherent incentive to cheat undermines the longevity of most cartels. In the long run, cartels wield less market power than monopolies.

Countries can unite to form a cartel, exemplified by OPEC (Oil Producing and Exporting Countries), the most well-known cartel. OPEC, established in 1960, aimed to set production limits and control petroleum prices. Although successful in the 1970s, OPEC has faced frequent violations of its agreement, often triggered by declining crude oil prices or heightened political tensions. Notably, Qatar, an OPEC member since 1961, departed the cartel in January 2019, likely influenced by political pressure and the aspiration to increase natural gas and crude oil production.