Contractionary monetary policy is a strategy employed by a central bank, such as the Federal Reserve in the United States, to decrease the money supply and slow economic growth.

A central bank usually implements contractionary monetary policy when policymakers are concerned that the economy may overheat and inflation may become excessive. These measures can slow the growth of the money supply.

Contractionary monetary policy is usually employed when the economy is approaching the peak of a business cycle. In these situations, consumer confidence is high. Most families enjoy higher incomes. Some are purchasing new homes or cars or treating themselves to vacations. Many families and businesses finance their acquisitions with debt, such as mortgages, business loans, car loans, or credit cards. After all, life is good. The economy’s aggregate demand is increasing, and they are confident their incomes will remain high.

During this period, businesses are thriving. Their biggest challenge is accommodating the increase in demand for their goods and services. Workers must work overtime. Companies must pay higher wages to retain workers. They may even need to hire and train new employees. Meanwhile, the rising demand for raw materials pushes up input prices. Manufacturing plants reached their maximum operating capacity. Companies add shifts and delay maintenance to complete customers’ orders. As a result of all this, the economy becomes overheated, and many businesses can’t keep pace with the increase in demand, so they raise their prices to reduce the quantity demanded rather than turn away customers.

The central bank must choose between slowing economic growth to reduce inflation or accepting the inflation and allowing the economy to continue to grow.

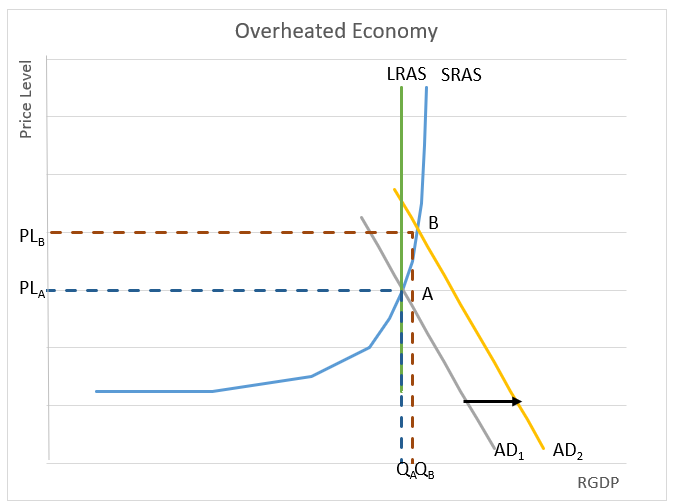

The graph below illustrates what is happening and the central bank’s dilemma. Assume the economy begins in its long-run equilibrium where the aggregate demand (AD1), short-run aggregate supply (SRAS), and long-run aggregate supply (LRAS) are in equilibrium. The economy’s output and price level are QA and PLA, respectively. Congress passed a tax cut that increased the aggregate demand to AD2, pushing output to QB and prices to PLB. Notice that output increases, but prices increase much more. Somehow, aggregate demand needs to be reduced to closer to AD1 if inflationary pressures are to be alleviated.

Monetary Policy – The Power of an Interest RateCauses of Inflation

Fiscal Policy – Managing an Economy by Taxing and Spending

Causes of Inflation