A core price index measures inflation without considering food and energy prices. The core consumer price index (CPI) and the core personal consumption expenditures (PCE) index are the two most widely used core price indexes.

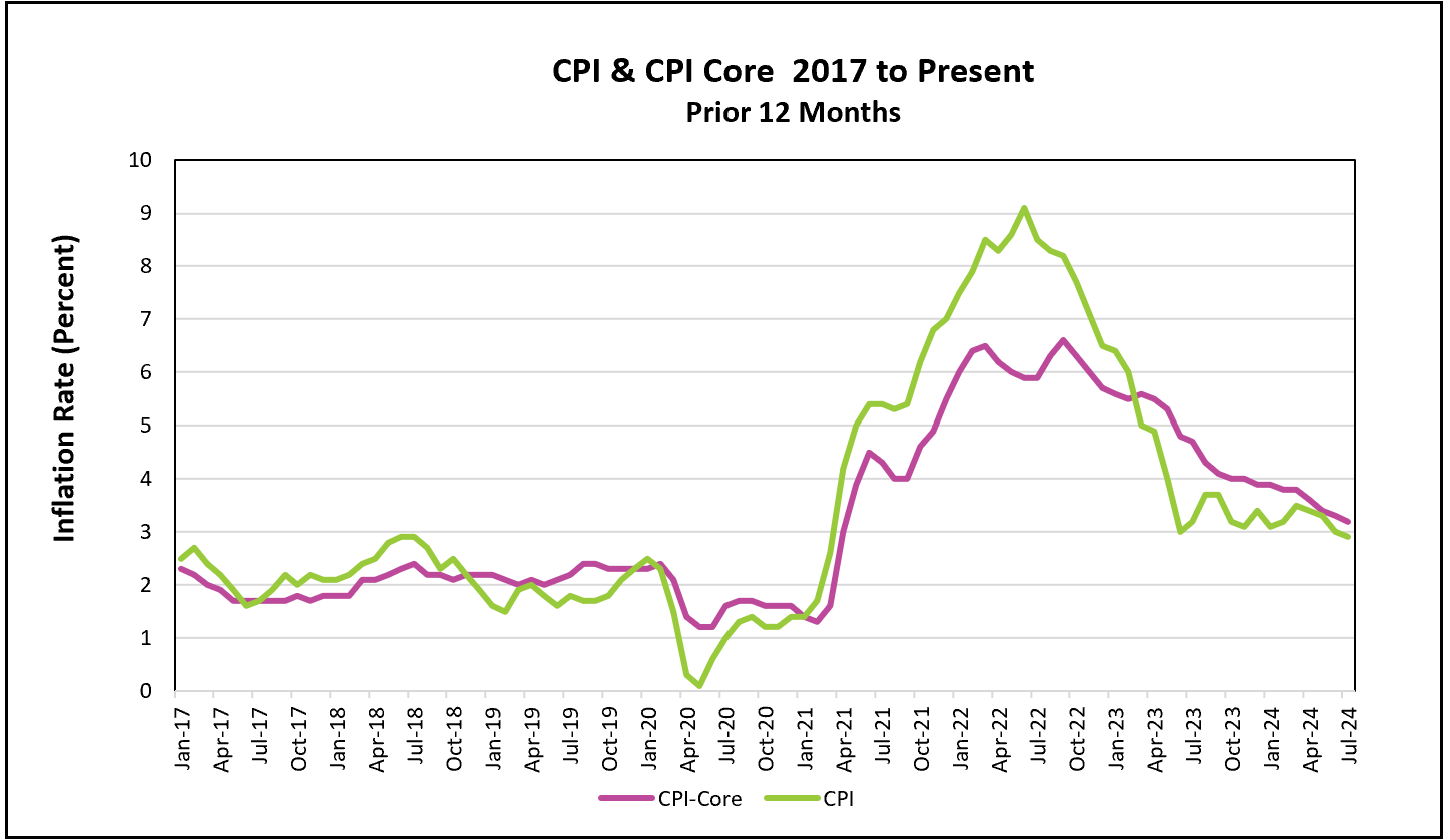

The consumer price index (CPI) is the most widely used measure of inflation, but it can be very volatile due to the volatility of food and energy prices. Food prices can be affected by changes in weather, diseases, and geopolitical instability, while energy prices are vulnerable to geopolitical events, natural disasters, and changes in global supply and demand. To address this volatility, economists use a core price index to determine the general trend in prices. The core indexes provide a more stable and accurate measure of underlying inflation trends, which is helpful when making policy decisions.

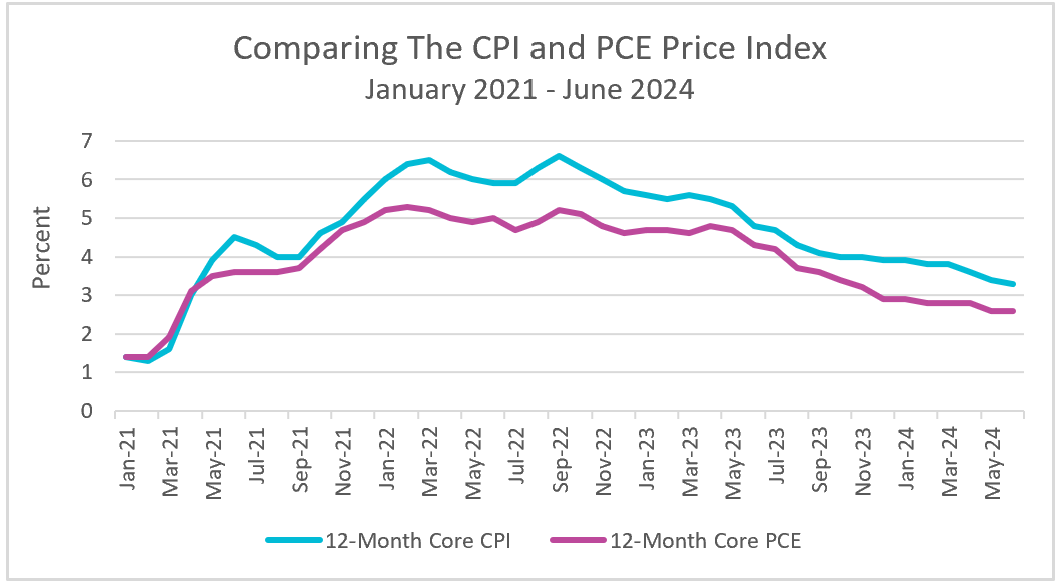

Even though the CPI is widely published, there are other important core indexes. The core personal consumption expenditures (PCE) price index is preferred by policymakers at the Federal Reserve, making it more important for evaluating monetary policy. The CPI compares items in a “basket” of commonly used goods and services and assumes no change in the basket contents. On the other hand, the PCE price index accounts for changes in spending behavior as the price of a good increases or decreases. For example, if consumers substitute chicken for beef following an increase in the price of beef, the weight given to chicken would increase in the PCE, reflecting this change in spending behavior. This substitution effect partially explains why the core PCE price index is usually slightly lower than the core CPI.

One of the objectives of monetary policy is to maintain stable prices. If the price level increases, the FOMC may raise interest rates to control inflation. However, this approach could be counter-productive if it is in response to a temporary increase in energy or food prices. For instance, in September 2017, during a long-term economic recovery, the Federal Reserve contemplated raising interest rates. The doubling of the monthly PCE price index from 0.2 to 0.4 percent contributed to a significant jump in the 12-month PCE price index from 1.4 to 1.7 percent, primarily due to higher energy costs. In October, gasoline prices decreased, resulting in a 0.1 percent increase in the PCE price index and an annual rate of 1.6 percent. If the Federal Reserve had solely focused on the PCE price index, it might have implemented a more restrictive monetary policy. (Refer to the full report at BEA Personal and Income Outlays – November 2017.)

Causes of Inflation

Inflation

Gross Domestic Product – Measuring an Economy's Performance