Deflation is the decrease in the price level for goods and services and an increase in the value of money.

Economists are concerned about deflation, which is most common during severe recessions or depressions. When prices fall, consumers may delay purchasing goods and services in anticipation of paying less if they wait. The logic is simple: why buy something today if it will cost less tomorrow? Similarly, businesses might postpone investments in equipment, expecting prices to drop further or waiting for consumer demand to recover. These behaviors suppress economic activity, exacerbate recessions, and hinder growth. For this reason, most economists prefer moderate inflation over deflation.

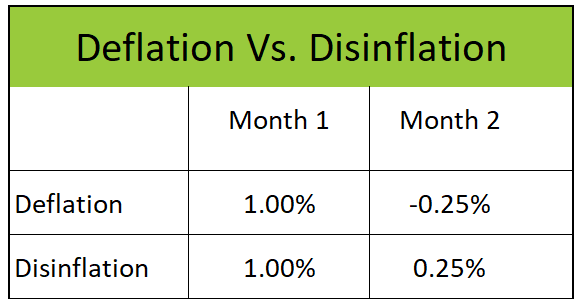

Deflation must not be confused with disinflation. Disinflation may be the desired result of monetary policy when a central bank wants to reduce the inflation rate. Disinflation is a slowing of the rate of inflation. Unlike deflation, prices continue to rise during disinflation, but less than in the prior period. For example, if January’s inflation rate equaled one percent, and February’s inflation equals negative 0.25%, deflation occurred, but if the inflation rate fell to 0.25%, disinflation occurred.

It is important to distinguish deflation from disinflation. Deflation refers to an actual decline in the overall price level, while disinflation refers to a slowing inflation rate. Disinflation is often the intended result of monetary policy when a central bank aims to reduce inflation. During disinflation, prices still rise but at a slower pace than before. For instance, if the inflation rate in January is 1%, and it decreases to 0.25% in February, disinflation has occurred. However, if February’s inflation rate drops below 0%—to, say, -0.25%—this signals deflation.

Unlike deflation, disinflation does not typically discourage economic activity. Consumers and businesses still have incentives to buy and invest in the present, as prices are rising, albeit at a slower pace, rather than falling.

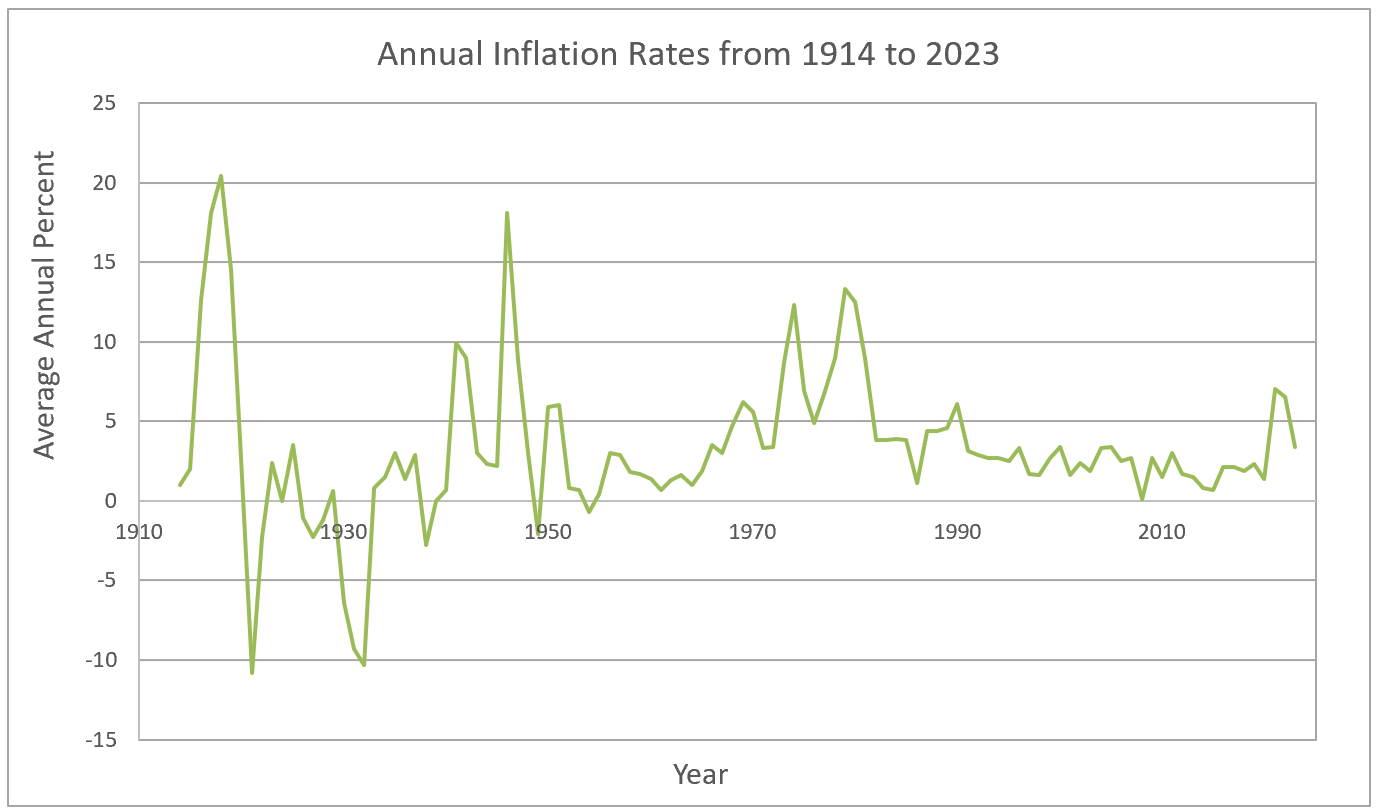

Deflation occurred during the Great Depression, with prices dropping by approximately 30%. It took more than a decade and the mobilization for World War II for the United States to fully recover from the economic downturn. More recently, Japan experienced a prolonged period of deflation and severe recession during the 1990s, often referred to as the “Lost Decade.” Japan has yet to regain the robust economic growth it enjoyed in the 1980s.

In contrast, the United States experienced disinflation between 1990 and 2020, with inflation falling to its lowest levels in nearly half a century.

Source: Bureau of Labor Statistics

Inflation

Causes of Inflation

Gross Domestic Product – Measuring an Economy's Performance

Monetary Policy – The Power of an Interest Rate

Business Cycles