Disinflation occurs during periods when the inflation rate decreases but remains above zero.

Disinflation must not be confused with deflation. Disinflation may be the desired result of monetary policy when a central bank reduces the inflation rate. Most economists consider deflation dangerous because consumers and businesses delay purchasing goods and services. Why buy something today when it may be less expensive tomorrow? Disinflation is a slowing of the rate of inflation. Unlike deflation, prices continue to rise during disinflation - they increase at a slower rate. Unlike deflation, consumers and businesses have an incentive to purchase a good or service today to avoid paying a higher price in the future.

To illustrate the distinction, assume the inflation rate equals four percent in Year 1. Disinflation occurs if the inflation rate in Year 2 is less than four but greater than zero. If the rate is less than zero, then the economy is experiencing deflation.

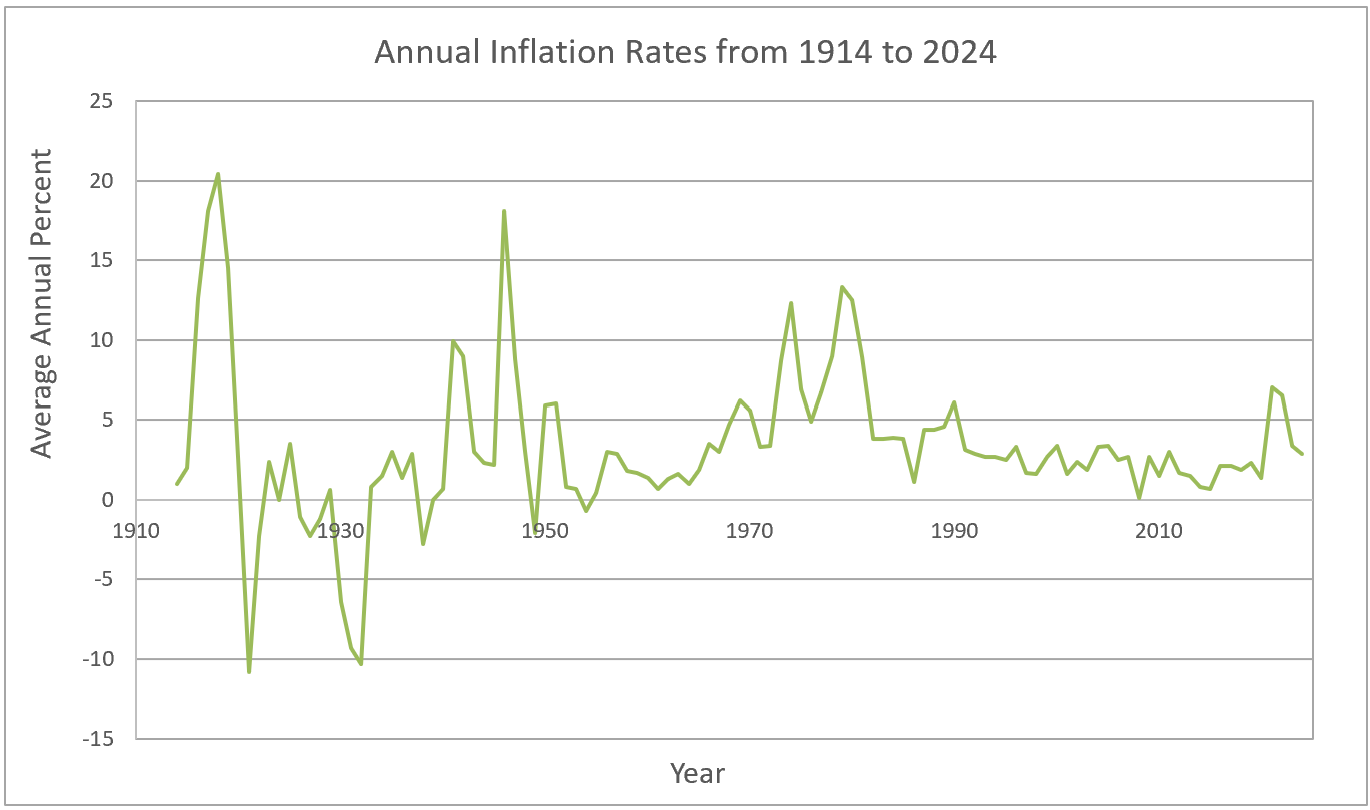

The graph shows that disinflation was prevalent between 1980 and 2019 because the price level trended lower. However, deflation occurred during the Great Depression of the 1930s, when the inflation rate dipped below zero.

The U.S. economy experienced deflation, disinflation, and inflation during and after the COVID-19 pandemic. The mounting number of deaths and the rapid spread of the virus led governments to implement severe containment measures to slow its progression. Lockdowns and closures resulted in a significant drop in business activity, with 20.5 million people losing their jobs in April 2020.

Disinflation occurred as prices decreased between March and May. Alarmed by the possibility of a severe recession, governments sent out large stimulus checks to provide financial support to families.

At the same time, businesses faced significant supply chain challenges and struggled to meet the rising demand for their goods and services. The combination of increasing aggregate demand and impaired aggregate supply caused prices to climb, with inflation peaking at 9.1% in June 2022. As inflation became the primary concern for policymakers, the Federal Reserve responded by raising interest rates to slow economic growth and reduce inflation. This approach aimed for disinflation, and it proved effective as the inflation rate began to decline.

Inflation

Causes of Inflation

Monetary Policy – The Power of an Interest Rate

Business Cycles