Luxury Tax

View FREE Lessons!

Definition of a Luxury Tax:

A

luxury tax is an excise tax on very expensive “luxuries.”

Detailed Explanation:

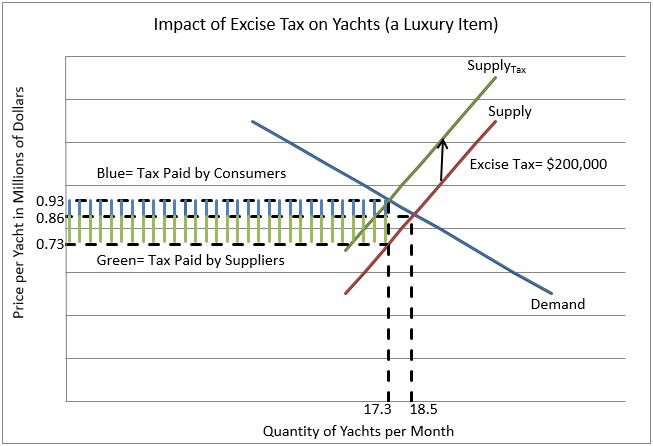

The political rationale is that those who can afford luxuries can afford to pay more in taxes, so they are charged a luxury tax. However, economic analysis shows that the tax burden can fall on the manufacturer, which in turn impacts the employees and local businesses. Luxuries, by definition, are not essential—consumers can do without them or substitute other products. For example, yachts are luxuries, and even the wealthy do not need them for travel. Yachts and other luxuries normally have elastic demand curves. On the other hand, manufacturers must invest heavily in equipment and space. They may have labor contracts that limit their flexibility in adjusting production, resulting in a supply curve that is more inelastic than the demand curve. A luxury tax will reduce the quantity demanded. Manufacturers and the employees of manufacturing companies may be hurt if the fall in the quantity demanded results in reduced production and layoffs.

The supply and demand graph below illustrates this scenario. Assume the government charges a $200,000 luxury (excise) tax on all yachts. The supply curve shifts to the left reflecting the higher cost to supply a yacht. Before the tax, an average of 18.5 yachts was sold per month at $860,000. The new equilibrium is 17.3 yachts and a price of $930,000 after the $200,000 excise tax is charged. The revenue generated per yacht falls to $730,000 and fewer yachts are sold. Clearly, the manufacturer is hurt by the excise tax. The area shaded green is the manufacturer's cost, while the blue area is the additional cost paid by the buyers.

Dig Deeper With These Free Lessons:

Who Really Pays an Excise Tax

Price Elasticity of Supply – How Does a Producer Respond to a Price Change

Price Elasticity of Demand – How Consumers Respond to a Price Change