Market Basket

View FREE Lessons!

Definition of a Market Basket:

In economics, a

market basket is an imaginary basket containing a standard set of goods and services commonly purchased by consumers used to track changes in the cost of living for different groups.

Detailed Explanation:

Calculating the inflation rate is theoretically simple, but in reality, the task is daunting. The prices of one period are compared to the prices of another period. The change in the average price is the inflation rate. But what items and what prices are used to get a good sample? The government uses “imaginary” market baskets. This basket is used to track changes in the cost of living for the average household over an extended period. The costs of the identical market baskets from different periods are compared. The inflation rate is the percentage change in the total cost of the two baskets. Massachusetts tracked inflation to adjust pay for soldiers during the Revolutionary War. The first basket included five bushels of corn, 68 4/7 pounds of beef, ten pounds of wool, and 16 pounds of leather. This would certainly not be a basket of goods commonly purchased by consumers today!

Many different baskets are used to measure inflation. The consumer price index (CPI) uses a basket of goods and services commonly purchased by an urban family. It is the most common measure of inflation because it is the broadest index that impacts the most people. Another basket includes goods and services sold in the wholesale market. Changes in the cost of this basket determine the producer price index (PPI), another measure of inflation. The producer price index measures inflation from the viewpoint of the sellers. The consumer price index and the producer price index are normally different because the market baskets used by the two groups differ, so the inflation rates for the two groups will probably vary.

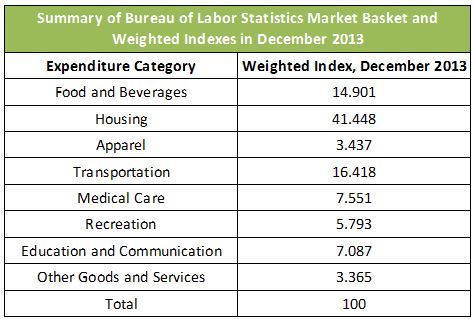

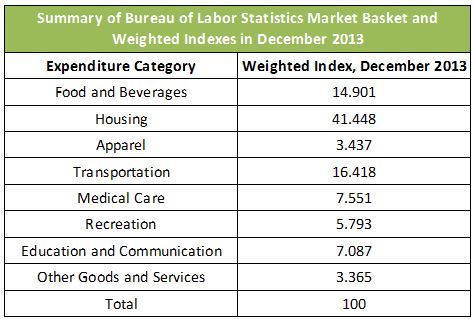

When calculating the US’s CPI, the Bureau of Labor Statistics is challenged to identify what should go in the market basket. If the items do not accurately represent what consumers buy, the calculated inflation rate will be inaccurate. Today, there are approximately 200 categories divided into eight groups in the market basket used to calculate the CPI. Each item is weighted by the probability that it will be purchased. For example, people buy food more often than they do clothes, so food is assigned a higher value than clothes. The table below shows the market basket categories and their weight in December 2013.

Source: Bureau of Labor Statistics - Table 1 on Page 4

Source: Bureau of Labor Statistics - Table 1 on Page 4

Market Baskets Must Change

To accurately measure inflation, market baskets must change to reflect current spending patterns. Imagine comparing price levels between 1950 and today using the same market basket. We have moved from typewriters to computers. Families had one phone in 1950, but a family of four today may have four or even five phones. Televisions now provide color, high definition pictures on large screens, rather than black and white pictures shown on a 1950 small screen television. In 1950, a family may have been able to access three channels. Today, literally hundreds of channels may be available. Our cars are more efficient and travel farther on a gallon of gas. Increases in the price of one good included in the market basket may prompt us to substitute another good. (See our lesson

Demand – The Consumer’s Perspective for a detailed discussion of the substitution effect.) These are examples of why the market basket must change periodically to reflect changes in our spending patterns. Collecting and analyzing the massive amount of data from consumers who retain a diary on their spending patterns is a complicated task, which explains why the CPI is frequently revised several weeks after it is released.

Dig Deeper With These Free Lessons:

Inflation

Gross Domestic Product – Measuring an Economy's Performance

Demand – The Consumer's Perspective