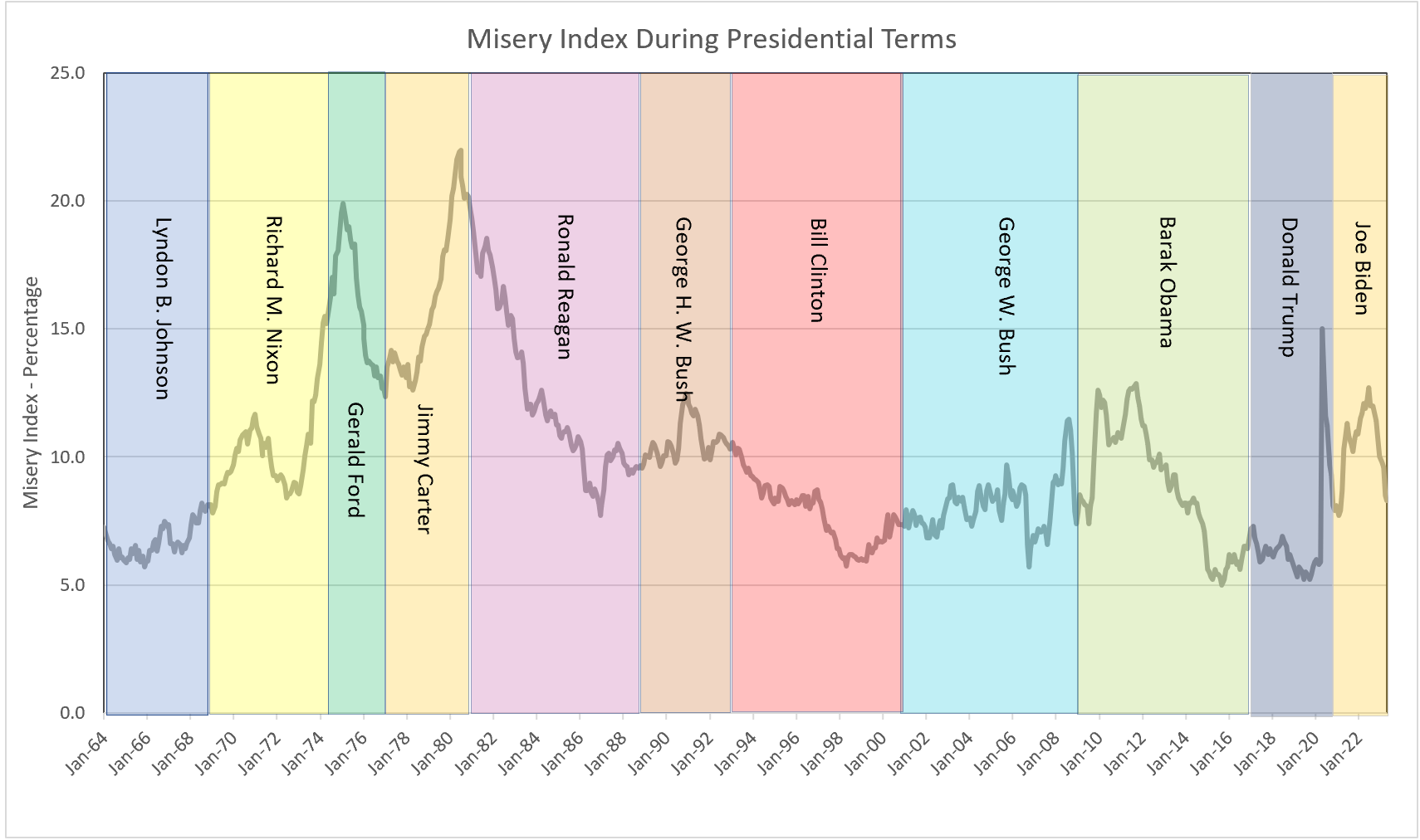

The misery index equals the sum of the inflation and unemployment rates. It provides an easy-to-understand measure of the state of the economy.

The misery index is an economic indicator that reflects the level of economic distress experienced by individuals in a country. It is the sum of the unemployment and inflation rates. The index is aptly named because, during periods of high unemployment and inflation, people often feel a sense of misery due to the challenges they face in their daily lives. The higher the index, the greater the overall misery experienced by the population.

One of the periods when the misery index tends to be highest is during stagflation. Stagflation refers to a situation where high inflation rates accompany a stagnant economy. During such times, unemployment also tends to be higher, exacerbating the economic distress individuals feel.

Usually, the relationship between unemployment and inflation is offsetting. In times of economic booms, businesses experience increased demand and are more inclined to hire and retain workers, leading to a low unemployment rate. However, this growing demand also allows businesses to raise their prices, resulting in increased inflation. Conversely, companies face pressure to reduce prices during recessions due to decreased demand and excess inventories, which leads to job cuts and reduced production, thereby increasing the unemployment rate.

Economists generally consider an index of 6-7 percent to be a healthy level. The natural level of unemployment is estimated to be around 4 percent, and the Federal Reserve typically aims for a 2 percent inflation rate. These figures provide a benchmark for evaluating the overall well-being of the economy.

Economist Arthur Okun introduced the concept of the misery index in the 1970s. Its simplicity and ability to gauge economic success made it an attractive tool for presidential candidates to discuss the state of the economy. In 1976, Jimmy Carter used the index to criticize the policies inherited by President Gerald Ford from President Nixon, whose actions, such as attempting to freeze prices and abandoning the gold standard, contributed to an increase in the misery index, which reached nearly 20 percent.

Source: Bureau of Labor Statistics June 6, 2023

The index gained further prominence during Ronald Reagan’s campaign against President Jimmy Carter. At that time, inflation soared to almost 15 percent, prompting the Federal Reserve, under Chairman Paul Volcker’s guidance, to significantly raise interest rates to combat inflation by slowing down the economy. Stagflation and a subsequent increase in unemployment followed. Reagan used this to his advantage, highlighting the high misery index as evidence of Carter’s economic failures.

Despite its widespread usage, the misery index has faced criticism as a comprehensive measure of the state of the economy. One notable criticism is that it fails to account for economic growth, which is a crucial aspect that can significantly impact the well-being of individuals.

Moreover, the index treats unemployment and inflation equally. However, a one percent increase in the unemployment rate likely causes more misery than a one percent increase in inflation. The impact of unemployment on individuals’ lives, such as financial strain and emotional distress, can be more significant.

The unemployment rate itself has its limitations. It only includes individuals who are working or actively seeking employment. During severe economic downturns, many individuals become discouraged and stop looking for a job, leading to an underrepresentation of the actual unemployment rate.

Furthermore, the unemployment rate is a lagging indicator. As a result, the unemployment rate may understate the true welfare of the economy during the early stages of a recession and overstate it during recovery.

Additionally, the misery index fails to account for deflation, which occurs when the price level falls. While a low misery index might suggest a positive state, deflation often accompanies periods of very low growth and depreciating asset values, bringing its own set of economic challenges.

To address some of these criticisms, economists have modified the misery index over time. For example, Robert Barro added measures such as consumer lending rates and economic growth to provide a more comprehensive assessment of economic well-being.

Monetary Policy – The Power of an Interest Rate

Fiscal Policy – Managing an Economy by Taxing and Spending

Causes of Inflation

Gross Domestic Product – Measuring an Economy’s Performance

Business Cycles