Price Taker

View FREE Lessons!

Definition of Price Taker:

A

price taker is a seller (or buyer) that has no influence on price. Price takers that are sellers can sell all their goods or services at the market price but zero at a price exceeding the market price.

Detailed Explanation:

The buyers and sellers of publicly traded shares such as Coca-Cola Co. stock are price-takers. There are approximately 4.4 billion shares of Coca-Cola Co. stock outstanding and there is absolutely no difference between shares. Over 230,000 individuals and entities own at least one share of Coca-Cola Co. Owning share number 100 carries the same per-share privileges as owning share number 100,000. Shares 100 and 100,000 are perfect substitutes. Buyers have no reason to pay any more than that moment’s market price, and sellers have no reason to sell for any less than the market price.

Companies operating in a perfectly competitive industry are price takers because each company sells a standardized (identical) good or service. The goods sold by one company are a perfect substitute for the goods sold by another company. Since the products are identical, a company is prevented from increasing its price because buyers will purchase the same product from another company.

Price takers are generally one of many in an industry. A company does not benefit from lowering its price to gain market share because it does not produce enough to influence the market, which means it can sell everything that it produces at the market price.

Farmer Jones’s farm is 5,000 acres. In the year 2000, approximately 520 million acres were used to grow wheat, so while a 5,000-acre farm is large, it is not large enough for Farmer Jones to have an impact on the market price of wheat since he produces only approximately 0.01 percent of the market. Wheat has many buyers because of its widespread uses. Food companies like General Mills and Kellogg’s buy enormous amounts of wheat, but even these large firms do not have sufficient clout to impact its price. The price of wheat is instead determined on the Chicago Board of Trade, where buyers and sellers come together in the same way the price of a stock is determined on the New York Stock Exchange. The market price for wheat may change, but it is determined in the marketplace by supply and demand, not by the actions of one buyer or one seller.

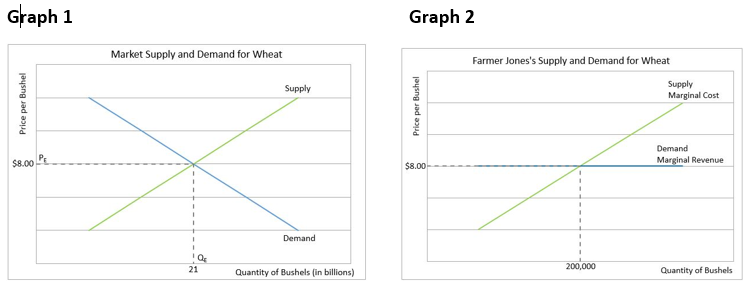

Assume the price for a bushel of wheat is $8.00. If Farmer Jones tried to increase his price to $8.25, he would not be able to sell any of his wheat. His sales would drop to zero! Frequently a business will lower its price to sell more of its goods or services, but this strategy does not make sense for Farmer Jones. There is no incentive for him to sell at $7.75 because he can sell his entire harvest for $8.00 a bushel. Farmer Jones is a price taker. He accepts the price the market dictates. Price takers have no effect on price. Price takers can sell all their goods or services at the market price, but nothing at a higher price. The only way Farmer Jones can increase his revenues is by increasing production. Farmer Jones’s situation is illustrated by Graphs 1 and 2. Graph 1 shows the market equilibrium and market price using the industry supply and demand curves. The market price, P

E is $8.00 per bushel. The entire industry produces 21 billion bushels (Q

E on Graph 1).

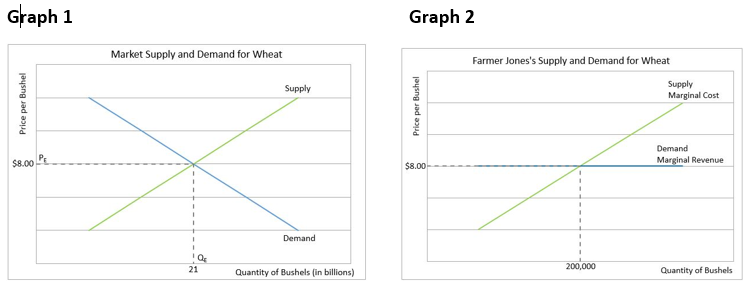

Graph 2 is Farmer Jones’s supply and demand curves. He produces 200,000 bushels, which is a tiny fraction of the total market. Farmer Jones has virtually no effect on the market supply. He has no bargaining power, so he must accept the market price. His demand curve is horizontal (perfectly elastic) because if he raised his price he would be unable to sell a single bushel, but he does not have an incentive to lower his price since he can sell all he produces without influencing the market price.

The demand curve is also Farmer Jones’s marginal revenue curve. Marginal revenue is the additional revenue from selling one additional unit of a good or service. Farmer Jones does not have to drop his price to sell even one additional bushel of wheat, so the demand curve is also the marginal revenue curve for companies operating in a perfectly competitive industry. Farmer Jones’s supply curve is determined by his costs, the weather, and the productivity of his land. The supply curve represents Farmer Jones’s marginal cost to produce a bushel of wheat. Farmer Jones’s most profitable production level is where the revenue derived from selling an additional bushel equals the cost to produce that final bushel, or where his marginal revenue equals his marginal cost.

Dig Deeper With These Free Lessons:

Market Structures Part I – Perfect Competition and Monopoly

Market Structures Part II – Monopolistic Competition and Oligopoly

Output and Profit Maximization

Supply and Demand – Producers and Consumers Reach AgreementPrice Elasticity of Demand – How Consumers Respond to Price Changes