Subsidy

View FREE Lessons!

Definition of a Subsidy:

A

subsidy is a direct payment or tax benefit to assist a business. Governments frequently subsidize businesses they want to promote or groups they want to help.

Detailed Explanation:

Subsidies are normally provided to industries that are viewed as vital to the country’s interests and may have difficulty competing in the free market. Subsidies are transfer payments. They are made without the exchange of a good or service. Examples of subsidies paid to individuals include welfare payments and unemployment insurance. In the 1960s and 1970s, the South Korean government wanted to build an export-driven economy. Leaders chose to subsidize several industries including electronics and automobiles. Today, South Korean companies like Samsung Electronics and Hyundai Motor are multinational and among the leading producers in these industries. Most European governments subsidize farmers so they can continue to sell their products below free-market prices. Alternative energy businesses are subsidized in the US to promote long-term energy independence. After a subsidy is paid, more output would be produced than in a free market because the producer’s cost would decrease.

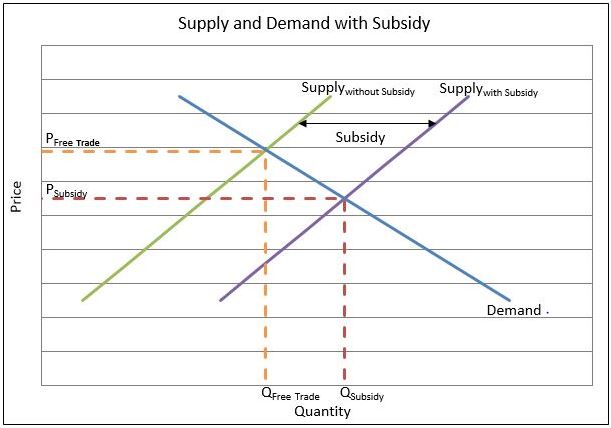

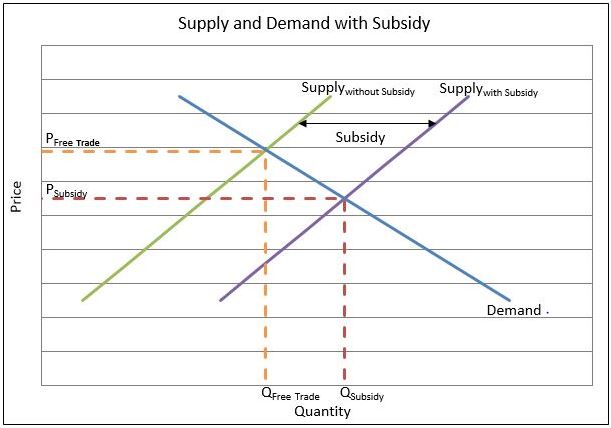

The impact of a subsidy can be illustrated using supply and demand analysis. The supply curve shifts down (right) to Supply

with subsidy by the amount of the subsidy. The price decreases to P

Subsidy, which is the price with a subsidy, from P

Free Trade, the price with free trade. Production increases from Q

Free Trade to Q

Subsidy.

Sounds great… lower prices… greater output—but there is a cost. More government spending probably requires higher taxes, incurring additional government debt. or both. Businesses that do not receive a subsidy still must compete with subsidized companies.

Dig Deeper With These Free Lessons:

Managing Supply Using Outsourcing, Tariffs, Subsidies, Quotas & LicensesChanges in Supply – When Producer Costs Change

Gross Domestic Product – Measuring an Economy's Performance

Economic Systems